The housing market’s been going through a lot of change lately, and there’s been uncertainty surrounding what will happen this spring. You may be wondering if more homes will go on the market, what’s next with home prices and mortgage rates, or what the best advice is for someone in your position right now.

Here’s what industry experts are saying right now about the spring housing market and what it means for you:

Selma Hepp, Chief Economist, CoreLogic:

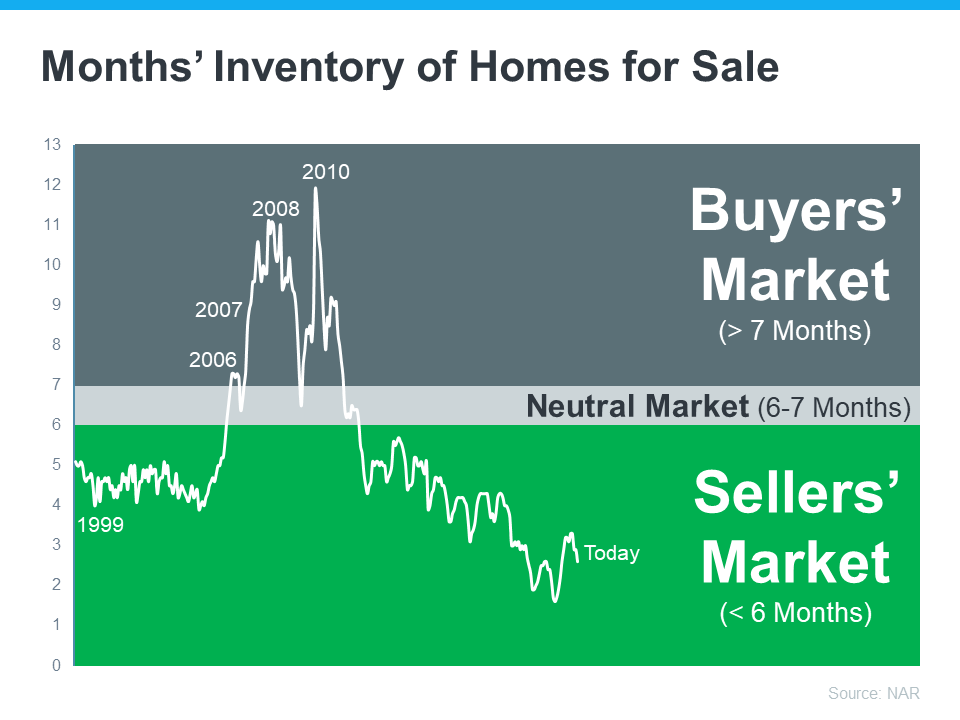

“We see more competition among buyers . . . Housing supply also tends to grow during the spring months. And this is also the time of year when relatively more migration happens, as people graduate and move elsewhere looking for jobs.”

Greg McBride, Chief Financial Analyst, Bankrate:

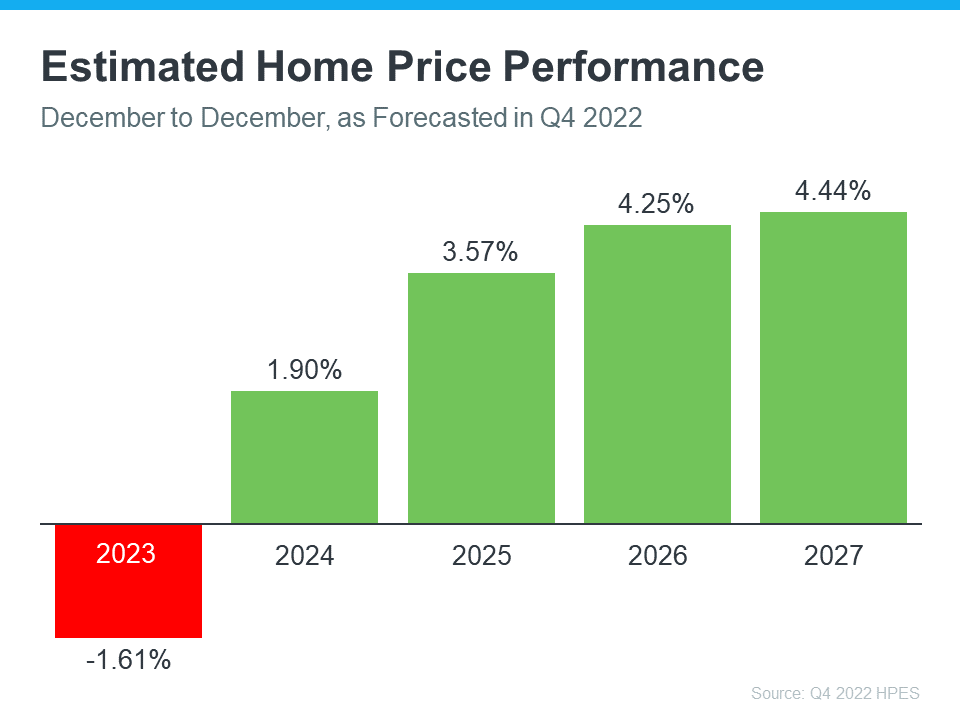

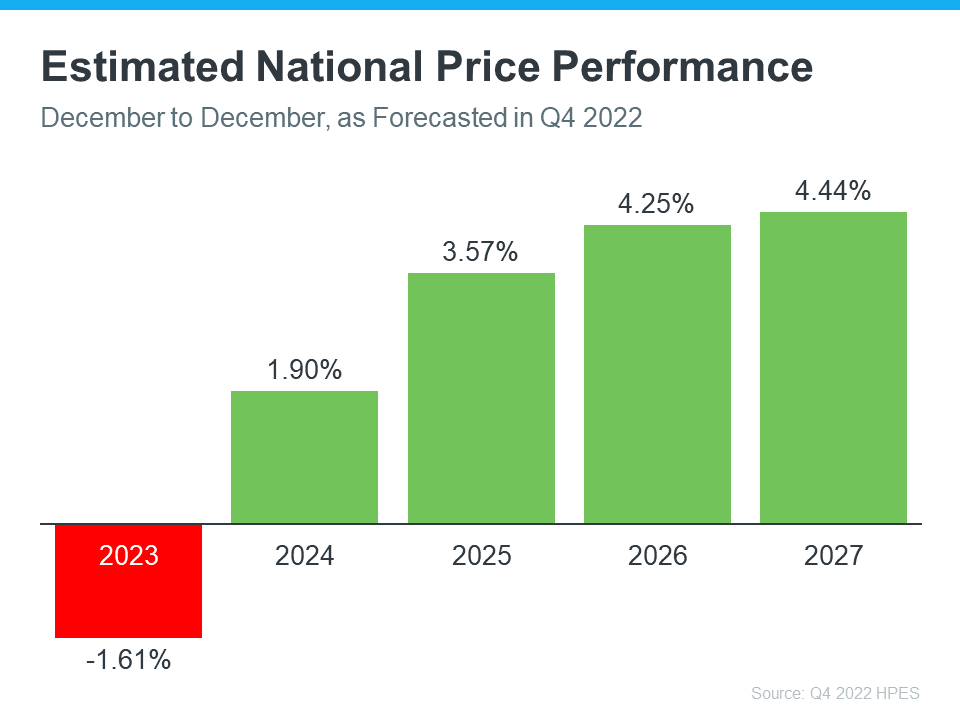

“I don’t expect big moves in prices in the span of a month, but like the flower buds of spring, the housing market is showing signs of improvement. A pick up in activity with inventory still low does bode well for home prices.”

Rick Sharga, Founder and CEO, CJ Patrick Company:

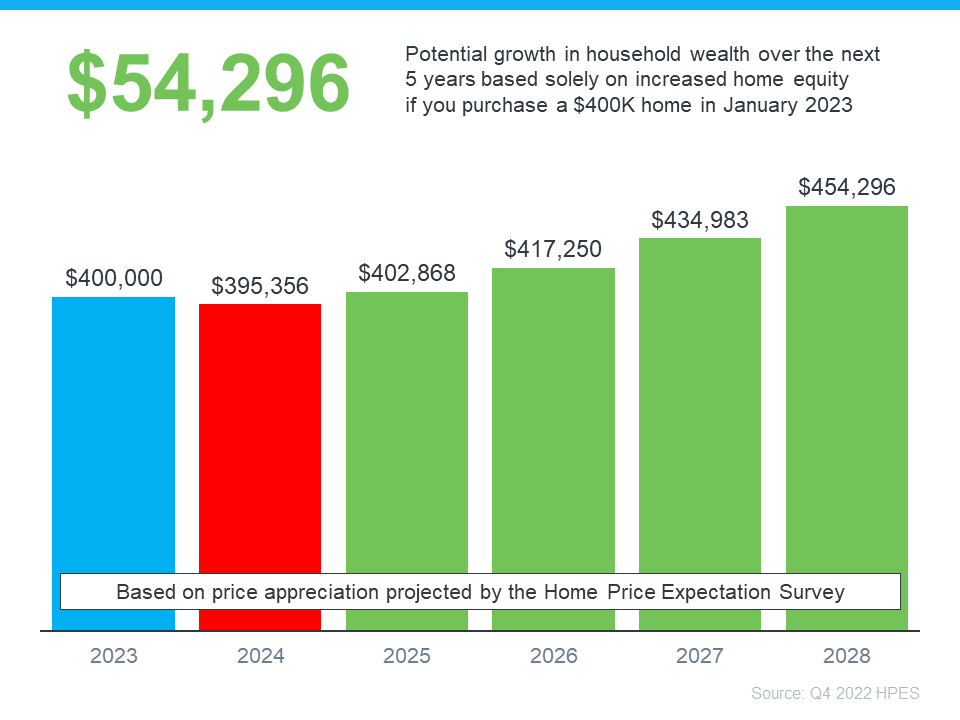

“If you can find a home you love and can afford at today’s prices, don’t wait. Home prices in most of the country are unlikely to crash, and mortgage rates will only come down very gradually if they decline at all this year.”

Jeff Tucker, Senior Economist, Zillow:

“The market is still much friendlier this spring for buyers who can overcome affordability hurdles, but buyers are going to see more competition than they might expect because there are not many homes on the market to go around. New listings are increasing, which they almost always do this time of year, but not nearly as quickly as usual.”

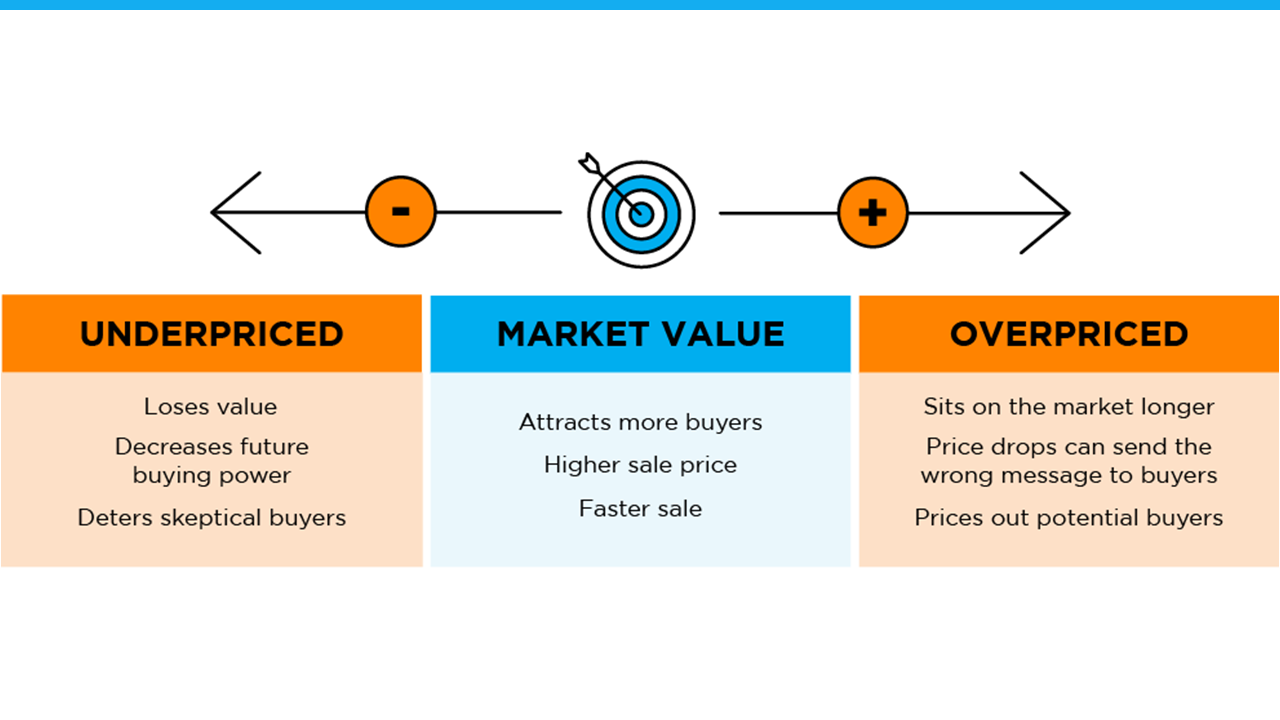

Bottom Line

If you’re thinking about selling your house, this spring’s a great time to do so while inventory is still so low. And if you’re in a good position to buy, lean on your team of expert advisors for the best advice. Whatever your plans, let’s connect to make sure you’re able to navigate the spring housing market with confidence.

Contact a GroupWatson Agent TODAY for Professional Advice & Expert Direction.

~Experience the GroupWatson Difference~

Call or Email Today!

972.370.1775|BuyOrSell@GroupWatson.com