According to the U.S. Census Bureau, this year, builders are on pace to complete more than a million new homes in this country. If you’ve had trouble finding a home to buy over the past year, it may be time to work with your trusted agent to consider a new build and the incentives that come with it. Here’s why.

The Supply of Newly Built Homes Is Rising

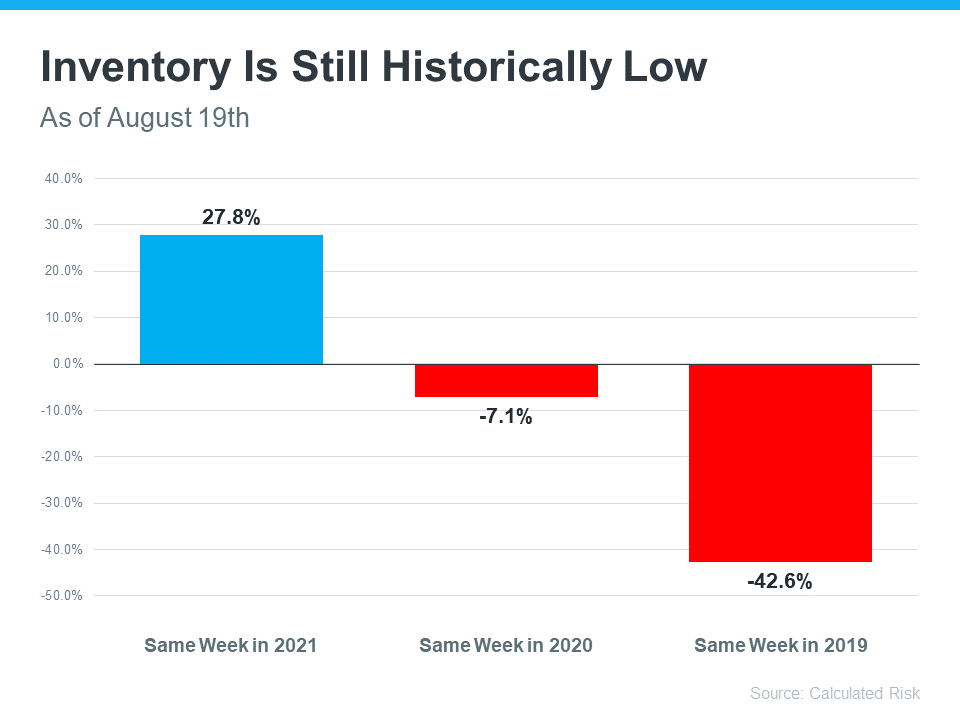

When looking for a home, you can choose between existing homes (those that are already built and previously owned) and newly constructed ones. While the inventory of existing homes is on the rise today, it’s still in tight supply, meaning it can be challenging to find just the right one.

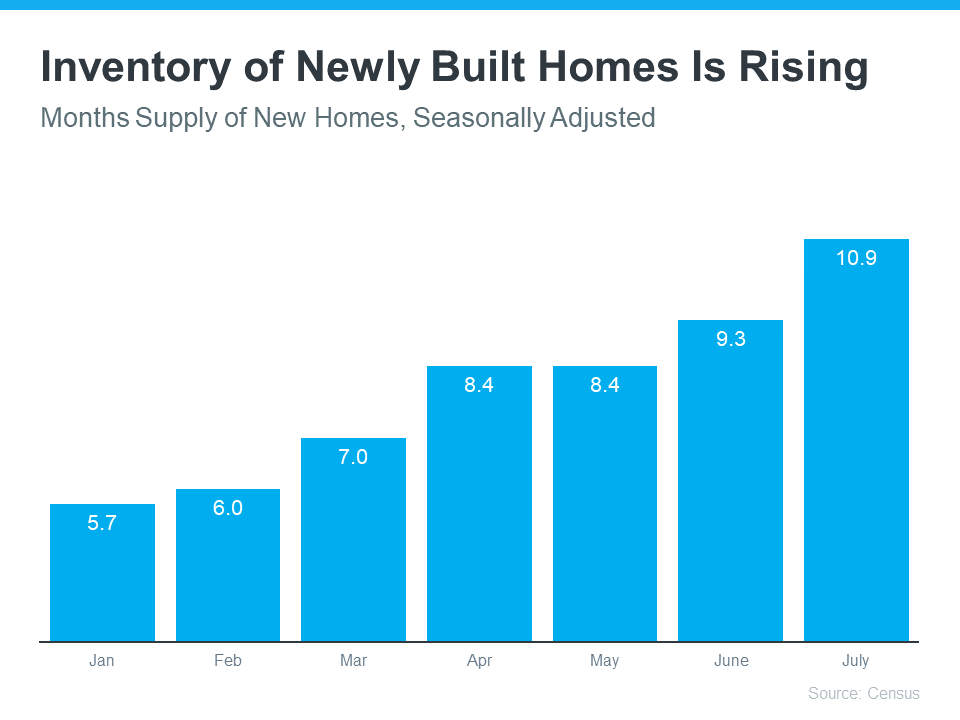

The inventory of newly built homes, however, is also rising. And with more options available than there have been in years, a new home may be just the answer you’re looking for. The graph below shows just how much the supply of newly built homes has grown this year.

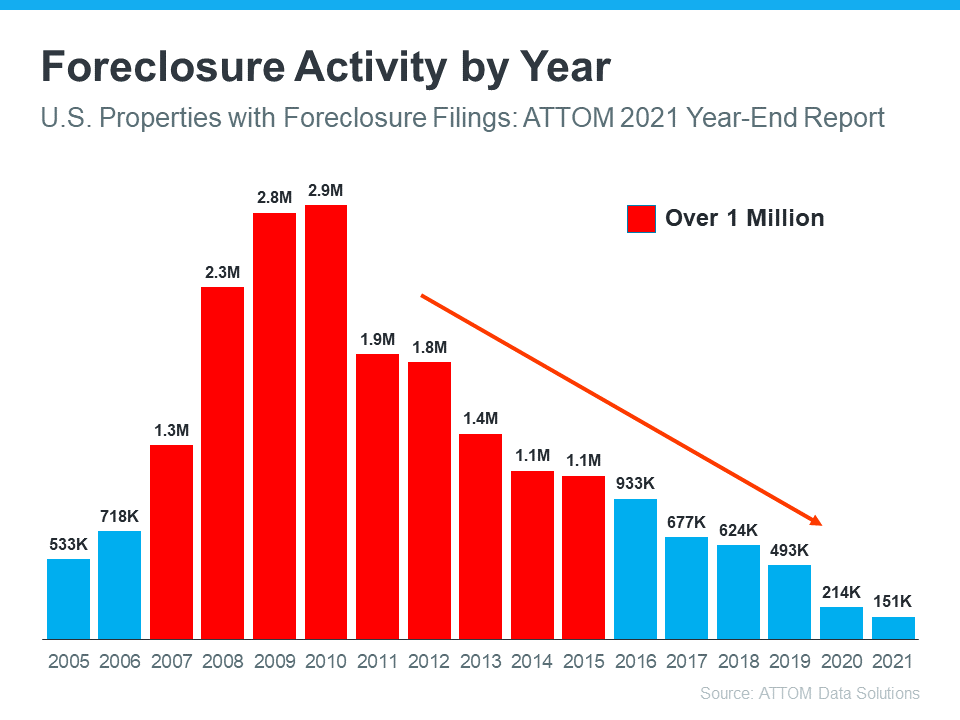

And here’s the thing – builders are also keeping a close eye on current market trends. With mortgage rates rising this year and, as a result, buyer demand softening, builders are slowing their pace of new construction. That’s because they learned their lesson in the housing crash of 2008 and want to avoid over-building and having too much inventory in their pipeline.

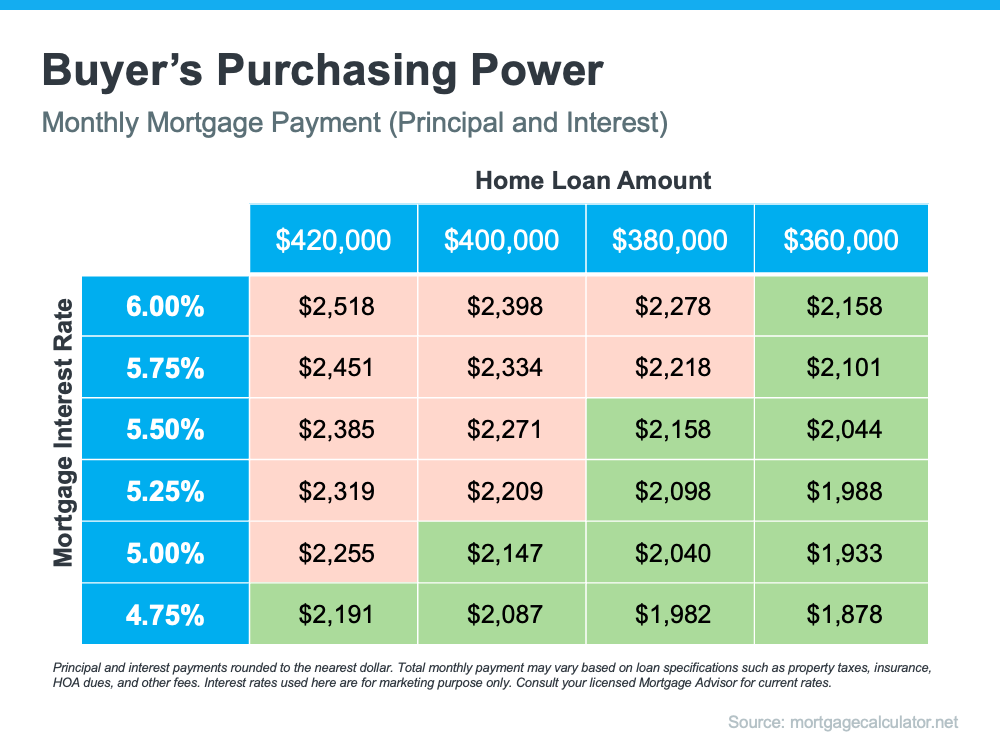

Basically, while there are more newly built homes on the market today than there have been in years, many builders want to sell their current inventory before adding much more – and that’s where you can really benefit. Today, builders may be more willing to work with buyers. According to a recent survey, 83% of builders have reduced their prices over the last three months.

What That Means for You

The current supply of newly built homes for sale coupled with the fact that data shows the majority of builders are doing price reductions are both great news for you. It means you may have more options and possibly some much-needed relief if you consider newly built homes in your search.

Bottom Line

If you’re ready to buy, it may be time to look for a newly built home. To learn what’s available in our area and what incentives these builders are offering, let’s connect today.

Contact a GroupWatson Agent TODAY for Professional Advice & Expert Direction.

~Experience the GroupWatson Difference~

Call or Email Today!

972.370.1775|BuyOrSell@GroupWatson.com

*GROUPWATSON’S FEATURED LISTING OF THE WEEK*